O papel da internacionalização, das exportações e do mercado interno na economia da moda: o caso da indústria calçadista brasileira

RESUMO

Este estudo visa identificar os principais temas e subtemas que caracterizam a dimensão econômica do setor calçadista brasileiro entre janeiro de 2022 e dezembro de 2023, bem como os resultados, desafios e tendências da indústria. Utilizando uma abordagem qualitativa com análise de conteúdo temática-categórica, foram analisados 21 relatórios mensais da Associação Brasileira das Indústrias de Calçados (Abicalçados). Os achados destacam a importância da internacionalização e das exportações para a competitividade do setor. Empresas com estratégias diversificadas enfrentam melhor os desafios da globalização, mudanças nas preferências dos consumidores e avanços tecnológicos. Tendências como a inovação em design e tecnologia e desafios como a concorrência asiática e questões logísticas foram identificados. Este estudo combina dados empíricos de relatórios setoriais com teorias acadêmicas, oferecendo uma análise interdisciplinar das transformações econômicas no setor calçadista brasileiro no período pós-pandemia. As implicações práticas incluem recomendações para empresas adotarem estratégias de internacionalização eficazes, inovação em design e tecnologia, e cooperação por meio de clusters para aumentar a competitividade. O estudo também sugere aos formuladores de políticas a importância de apoiar a indústria com incentivos e políticas públicas que promovam sustentabilidade e inovação.

Palavras-chave: Indústria Calçadista Brasileira; Internacionalização; Exportações; Economia Pós-Pandemia; Mercado doméstico.

The role of internationalization, exports and domestic market in the fashion economy: the Brazilian footwear industry case

ABSTRACT

This study aims to identify the main themes and subthemes that characterize the economic dimension of the Brazilian footwear sector between January 2022 and December 2023, as well as the results, challenges and trends of the industry. Using a qualitative approach with thematic-categorical content analysis, 21 monthly reports from the Brazilian Footwear Industry Association (Abicalçados) were analyzed. The findings highlight the importance of internationalization and exports for the competitiveness of the sector. Companies with diversified strategies better face the challenges of globalization, changing consumer preferences and technological advances. Trends such as innovation in design and technology and challenges such as Asian competition and logistical issues were identified. This study combines empirical data from sectoral reports with academic theories, offering an interdisciplinary analysis of the economic transformations in the Brazilian footwear sector in the post-pandemic period. Practical implications include recommendations for companies to adopt effective internationalization strategies, innovation in design and technology, and cooperation through clusters to increase competitiveness. The study also suggests to policymakers the importance of supporting the industry with incentives and public policies that promote sustainability and innovation.

Keywords: Brazilian Footwear Industry; Internationalization; Exports; Post-Pandemic Economy; Domestic market.

El papel de la internacionalización, las exportaciones y el mercado interno en la economía de la moda: el caso de la industria del calzado brasileño

RESUMEN

Este estudio tiene como objetivo identificar los principales temas y subtemas que caracterizan la dimensión económica del sector brasileño del calzado entre enero de 2022 y diciembre de 2023, así como los resultados, desafíos e las tendencias de la industria. Mediante un enfoque cualitativo con análisis de contenido temático-categórico, se analizaron 21 informes mensuales de la Asociación Brasileña de la Industria del Calzado (Abicalçados). Los hallazgos resaltan la importancia de la internacionalización y las exportaciones para la competitividad del sector. Las empresas con estrategias diversificadas enfrentan mejor los desafíos de la globalización, las cambiantes preferencias de los consumidores y los avances tecnológicos. Se identificaron tendencias como la innovación en diseño y tecnología y desafíos como la competencia asiática y cuestiones logísticas. Este estudio combina datos empíricos de informes sectoriales con teorías académicas, ofreciendo un análisis interdisciplinario de las transformaciones económicas del sector del calzado brasileño en el período pospandemia. Las implicaciones prácticas incluyen recomendaciones para que las empresas adopten estrategias efectivas de internacionalización, innovación en diseño y tecnología, y cooperación a través de clusters para aumentar la competitividad. El estudio también sugiere a los responsables de la formulación de políticas la importancia de apoyar a la industria con incentivos y políticas públicas que promuevan la sostenibilidad y la innovación.

Palabras-clave: Industria Brasileña del Calzado; Internacionalización; Exportaciones; Economía pospandemia; Mercado doméstico.

1. INTRODUCTION

Historically, the Brazilian footwear industry dates to the 19th century, linked to tanneries and production for immigrants (Reichert, 2004). Production was centered in Vale dos Sinos (Rio Grande do Sul) and Franca (São Paulo) by small workshops (Costa, 2004; Schemes, 2006). German immigration in 1824 influenced the emergence of shoemaking with experience in tanning and crafts (Costa; Passos, 2004; Schemes, 2006). Initially manual, production became mechanized in the late 19th and early 20th centuries, especially with steam machines, maintaining artisanal traits until the 1960s (Costa, 2004).

Considerable changes in the national footwear industry occurred after the 1960s, when exports became a reality for the sector (Costa, 2004). Vale dos Sinos stood out as an important industrial hub due to its political relations, strategic position in the international market, and recognized leather production (Costa, 2004). From the 1970s onwards, the leather-footwear industry in Rio Grande do Sul underwent a new process of industrialization and exportation, expanding its production, technological and capital base (Schneider, 2004). However, competition with Asian products, especially from China, in the 1980s and 1990s, resulted in a loss of value and economic crises (Costa, 2004).

Nowadays, the Brazilian footwear industry continues to be challenged by Chinese production and other global competitors from Asia, facing issues of import and export, counterfeit production, technological development and cheaper production (Abicalçados, 2023). However, Brazilian brands still stand out for their use of superior-quality leather and innovative design, maintaining their relevance in the domestic and foreign markets (Abicalçados, 2024).

The Associação Brasileira das Indústrias de Calçados (Abicalçados) produces various services and publications for the footwear sector, such as Abinforma, sectoral and annual reports, market studies, and foreign trade reports. Given this research’s focus on post-pandemic trends and challenges (2022-2023), we analyzed only the monthly Abinforma reports, which provide updates on the national footwear industry’s development. Our previous research indicates that internationalization and exports are crucial for global competitiveness. Therefore, we focus on this point of view.

Moreover, this research uses a qualitative thematic-categorical content analysis to study a set of textual data in the form of a monthly report market report produced by Abicalçados, about the Brazilian footwear industry in the post-pandemic period. Therefore, the research aims to identify the main themes and subthemes that characterize the economic dimension of the Brazilian footwear sector during this period, as well as the trends, challenges, and results of the industry.

Nevertheless, this study is justified by its relevance for the Brazilian footwear industry and academia, as it brings an interdisciplinary approach, combining empirical data, present in the reports, with academic theory. The research contributes to knowledge about the trends, challenges, and results of the industry in the post-pandemic period, providing information and questions for companies, public managers, and researchers.

Afterward, the objective of this study is to analyze the results, challenges, and trends associated with the Brazilian footwear industry in the post-pandemic period (2022-2023), using a qualitative thematic-categorical content analysis. Our focus was related only to the economic dimension of the footwear industry, especially the role of internationalization, exports, and the characteristics of the domestic market.

2. INTERNATIONALIZATION STRATEGIES

The theoretical evolution of international business studies began with economic theories that explained global financial flows from a macroeconomic perspective. Over time, the focus shifted to industry and later to firms, influenced by the studies of Penrose (1959). Today, institutional theory is gaining importance in explaining internationalization, particularly in emerging economies.

Dunning and Lundan (2008) argue that classical and neoclassical economic theories focused on production location, treating the international market as a cost mechanism. These theories had limitations, such as ignoring organizational specificities, assuming resource immobility across borders, and considering companies as fully rational actors seeking profit maximization in perfect markets (Stallkamp & Schotter, 2021; Yan et al., 2023). International business studies, in general, are responses to these shortcomings and are usually divided into two broad approaches: economic and behavioral.

The economic approach applies Transaction Cost Theory to international business. Key theories within this perspective include Market Power Theory (Hymer, 1976), Product Life Cycle Theory (Vernon, 1966), Internalization Theory (Buckley & Casson, 1976), and the Eclectic Paradigm (Dunning, 1988).

The behavioral approach is based on the Uppsala School examines internationalization from a behavioral perspective, focusing on the company as the unit of analysis. According to this approach, a firm’s international expansion occurs gradually through learning and experience in international business (Johanson & Vahlne, 1977). By studying Swedish companies, Johanson and Vahlne (1977) observed a typical pattern of internationalization: firms first establish themselves in the domestic market, then begin exporting through agents, later transition to sales subsidiaries abroad, and eventually set up production in the target country. This step-by-step process highlights the role of experiential learning in international expansion. Key aspects of this approach include its gradual and dynamic nature. Internationalization occurs in stages, not as a result of a predetermined or rational strategy, but rather as a consequence of experiential learning. Companies tend to expand first into countries with less psychic distance, that is, markets that are culturally, linguistically, or geographically similar, making the transition smoother.

Network Theory is considered an evolution of the Uppsala Model. Johanson and Vahlne (1990) expanded their original framework by incorporating the role of business relationships and networks. When a company internationalizes, it builds connections with customers, suppliers, distributors, governments, and other institutions. These relationships can create new opportunities, sometimes leading firms to expand in ways that deviate from the gradual patterns predicted by the Uppsala Model. In 2009, Johanson and Vahlne re-examined the Uppsala Model, introducing the concepts of opportunities and knowledge. They expanded the definition of knowledge to include a firm’s needs, capabilities, strategies, and opportunities. The updated model also emphasized learning, trust-building, and commitment between business partners, highlighting the importance of a firm’s position within its network of relationships.

Schweizer, Vahlne, and Johanson (2010) expanded the study of internationalization by incorporating entrepreneurial capabilities and analyzing how firms navigate uncertainties, opportunities, learning, and knowledge. Later, Johanson and Vahlne (2017) revisited the Uppsala Model, emphasizing the role of international networks and the increasing impact of digitalization in lowering barriers to market entry and learning. Advances in technology have made information more accessible, reducing firms’ reliance on the gradual, experience-based approach outlined in the original model.

3. METHODOLOGY

This topic presents methodological procedures.

3.1 Methodological procedures, data collection and corpus construction

We conducted documentary research based on Abinforma reports by Abicalçados, focusing on extracting information to understand the phenomenon (Kripka; Scheller; Bonotto 2015). With this in mind, we focused on the textual and graphical materials contained in the reports, specifically in the news presented each month.

Between January 2022 and December 2023, Abicalçados launched a total of 21 reports in the Abinforma category. There was no report released in October 2022, and for the months of November and December, a single report was produced each year. Thus, the corpus of the empirical study included a total of 21 reports, characterized as shown in Table 1. The identification of reports in our spreadsheet was made up of their year added to the month in question, for example, 202201 comprises the report produced in January (01) of the year 2022.

Table 1. Composition of the document corpus – Abinforma Reports

|

ID |

Title |

No. of pages |

Quant. of words |

|

202201 |

“Number of franchises grows throughout Brazil” |

39 |

13.847 |

|

202202 |

“Differentials qualify Brazilian footwear exports” |

32 |

11.575 |

|

202203 |

“Women who develop the footwear sector” |

26 |

8.794 |

|

202204 |

“Physical events boost exports” |

30 |

10.007 |

|

202205 |

“Challenges of the footwear industry” |

34 |

12.910 |

|

202206 |

“Footwear chain celebrates pact for sustainability” |

28 |

10.570 |

|

202207 |

“Logistics is a challenge for the footwear sector” |

33 |

11.295 |

|

202208 |

“The footwear industry has already generated more than 27 thousand jobs in 2022” |

29 |

11.487 |

|

202209 |

“E-commerce represents more than 30% of shoes sold in Brazil” |

25 |

8.974 |

|

202211-12 |

“What to expect from the Brazilian footwear industry in 2023” |

31 |

13.054 |

|

202301 |

“The footwear industry is more cautious, but foresees growth” |

32 |

10.783 |

|

202302 |

“Brazilian footwear show: the Brazilian footwear fair” |

31 |

10.797 |

|

202303 |

“International actions increase footwear exports” |

34 |

14.543 |

|

202304 |

“Four decades alongside the national footwear sector” |

25 |

8.536 |

|

202305 |

“Footwear consumption is expected to increase by more than 3% in 2023” |

29 |

12.618 |

|

202306 |

“Sustainability: a reality of no return for the footwear production chain” |

30 |

13.629 |

|

202307 |

“Latin America produces more than 1.5 billion pairs of shoes” |

26 |

10.496 |

|

202308 |

“Union of the footwear sector strengthens BFShow” |

23 |

7.387 |

|

202309 |

“International scenario impacts on exports from the production chain” |

28 |

12.717 |

|

202310 |

“Current scenario points to growth in the footwear industry” |

33 |

11.207 |

|

202311-12 |

“First edition of BFShow mobilizes the national footwear sector” |

39 |

13.593 |

|

Total |

637 |

238.819 |

Source: prepared by the authors according to research data.

3.2 Data analysis

The data exploration strategy followed the thematic-categorical content analysis proposed by Bardin (1997), focusing on pre-defined categories aligned with the research objectives. This method enables systematic analysis of language, messages, and texts to understand their structure, content, and context (Bardin, 1997). As noted by Sampaio and Lycario (2021), thematic-categorical analysis allows for objective inferences by coding content into distinct categories—results, challenges, and trends.

Our qualitative analysis involved a review of 21 reports, mapping recurring themes and organizing them into a triadic structure reflecting the research focus. The data was recorded in a Microsoft Excel spreadsheet, facilitating categorization into results, challenges, and trends. Each report was revisited, categorizing news items based on identified themes, with the flexibility to classify them under multiple axes when necessary. This approach captured the complexity of the reports, revealing nuanced interconnections between topics.

3.3 Background of the study

In previous research, we identified three central themes characterizing the Brazilian footwear industry post-pandemic: (1) exports, internationalization and the domestic market; (2) cooperatives, associations and business fairs; and (3) sustainable aspects. This study focuses on the first theme, which follows the following key concept:

- Exports, internationalization and domestic market: It covers the Brazilian footwear sector’s international market performance, including export volumes, new markets, international fairs, commercial agreements, company strategies, investments, product launches, competitive analyses, and economic impacts.

In general, we found 339 items/report news among the 21 Abicalçados reports, classifying them into the three categories mentioned above and within the three subcategories of interest explained in the methodology (results, challenges, and trends). Among them, 164 items were related to “exports, internationalization and market”.

4. RESULTS

This topic presents the results of the document analysis.

4.1 Market results in the economic sector of the Brazilian footwear industry

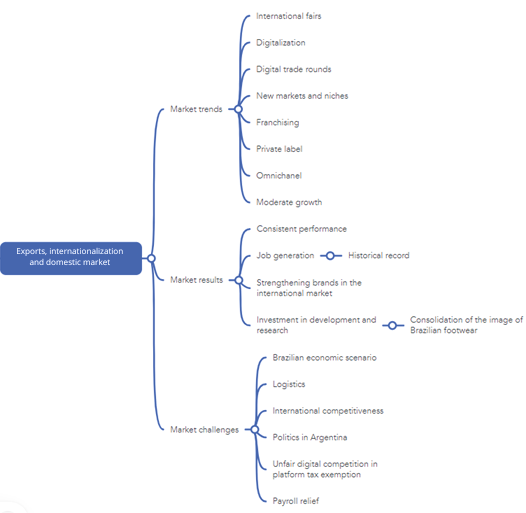

We identified 164 items that made up this category, classified according to Figure 1. Regarding the “results” subtopic, we found such affinities in 71 of the 164 news/items (43.29%). In this way, we observed a positive general performance of the footwear industry in the past two years. Especially when considering the contextual insertion in a post-pandemic period and its recovery, with consistent performance in production, sales, and job creation.

Therefore, exports continued to be one of the central competitive factors of the Brazilian footwear industry, guaranteeing revenue for several companies, with an increase of 36.8% in 2021 (Abicalçados, 2022a), remaining constant or increasing over the two next years. In the first half of 2022, exports reached around US$651 million (Abicalçados, 2022g), while in the second half, until October of the same year, this amount had already increased to US$1.1 billion (Abicalçados, 2022j). In 2023, these results remained constant, reaching US$626 million in the first half of the year (Abicalçados, 2023g), reaching US$1 billion by October of the same year (Abicalçados, 2023k).

Figure 1. Results of item categorization for “exports, internationalization and domestic market”

Source: Prepared by the authors (2024).

It is interesting to note the presentation of this data in the report, where each month the final pages are dedicated to a graph reporting the main Brazilian exporting states, and the main countries from which Brazil imports footwear (Table 3). In both years (2022 and 2023), Rio Grande do Sul emerged as the Brazilian state with the largest export market share, followed by Ceará; and a dispute between China and Vietnam as the places where Brazil imports the most footwear.

Table 3. Summary of export and import results 2022 and 2023

|

Exports |

||||||

|

Year |

Brazilian state |

Volume (millions of pairs) |

Variation (%) |

|||

|

2022 |

Rio Grande do Sul |

25,76 (2021) -> 36,57 (2022) |

41,9% |

|||

|

Ceará |

20,42 (2021) -> 23,96 (2022) |

16,1% |

||||

|

Paraíba |

12,79 (2021) -> 14,67 (2022) |

14,6% |

||||

|

Total |

99,09 (2021) -> 119,14 (2022) |

20,2% |

||||

|

2023 |

Ceará |

34,78 (2022) -> 31,25 (2023) |

-10,2% |

|||

|

Rio Grande do Sul |

25,76 (2022) -> 30,16 (2023) |

16,7% |

||||

|

Paraíba |

14,94 (2022) -> 16,34 (2023) |

9,4% |

||||

|

Total |

119,14 (2022) -> 120,44 (2023) |

1,1% |

||||

|

Imports |

||||||

|

Year |

Country |

Volume (millions of pairs) |

Variation (%) |

|||

|

2022 |

China |

6,03 (2021) -> 8,10 (2022) |

34,4% |

|||

|

Vietnam |

7,04 (2021) -> 7,17 (2022) |

1,8% |

||||

|

Indonesia |

6,78 (2021) -> 7,87 (2022) |

16,1% |

||||

|

Total |

17,85 (2021) -> 23,14 (2022) |

29,7% |

||||

|

2023 |

China |

9,18 (2022) -> 8,83 (2023) |

-3,8% |

|||

|

Vietnam |

7,28 (2022) -> 8,93 (2023) |

22,5% |

||||

|

Indonesia |

6,85 (2022) -> 9,45 (2023) |

38,1% |

||||

|

Total |

23,14 (2022) -> 27,21 (2023) |

17,6% |

||||

Source: Adapted from Abicalçados reports (2022j; 2023k)

One main result from this period is job generation, with the industry achieving historical records. In July 2022, it was reported that the footwear industry had its best job creation result since 2004 (Abicalçados, 2022g). In December 2022, it recorded the best result in seven years (Abicalçados, 2022g; 2022j). However, 2023 saw inconsistencies, starting with a positive gain of 1300 jobs in January (Abicalçados, 2023c), but declining by June due to reduced production (Abicalçados, 2023f). By November and December, there was a significant job loss attributed to unfair competition on marketing platforms. Between January and September, the industry lost 333 jobs, with a projected increase by year-end, employing 296,000 people, 6.4% less than the same period in 2022 (Abicalçados, 2023k). These causes will be explored in the challenges section.

Another relevant result was the strengthening of brands and companies in the international market. We understand that the internationalization actions to which Abicalçados is dedicated, such as participation in international fairs and trade missions, boosted the growth of exports, with emphasis on the markets of Latin America, Europe, and United States. This is also closely related to the connection with ApexBrasil, especially with the renewal of the 35 million agreements for international promotion (Abicalçados, 2022c). On international missions, the footwear manufacturers returned from Colombia with more than US$1.7 million in business done (Abicalçados, 2022h).

Investments in research and development grew by 33.4% (Abicalçados, 2022c), leading to the launch of platforms, reports, and materials by Abicalçados and its associates. The February 2022 report (Abicalçados, 2022f) states that the unique characteristics of Brazilian footwear boosted sales, highlighting cases such as Beira Rio, Andacco, Pampili, Savelli, Suzana Santos, and Carrano. Competitive advantages include production flexibility, allowing for smaller batches based on importer demand, internationally recognized quality and credibility, and a transparent, innovation-driven production chain. Sustainability is also a key factor, with Beira Rio reaching the highest level in the Sustainable Origin program. Close customer relationships, distinctive design, and product diversification further enhance competitiveness, along with the careful selection of raw materials, such as leather, often produced in-house to ensure superior quality (Abicalçados, 2022f).

4.2 Market challenges in the economic sector of the Brazilian footwear industry

The Brazilian footwear industry continues to face substantial challenges related to exports, internationalization, and the domestic market. From the 164 items analyzed across the Abicalçados reports, 40 (24.39%) were specifically focused on challenges (Abicalçados, 2022a). The domestic market in 2020 saw significant decline due to the pandemic’s effect on industrial production and footwear consumption. In May 2022, key obstacles included exchange rate fluctuations, as well as increasing costs of raw materials and labor (Abicalçados, 2022e). These rising costs, exacerbated by the global health crisis and the war in Ukraine, placed significant pressure on the competitiveness of Brazilian footwear companies in the post-pandemic context.

In the same report, Carlos Alexandre da Costa, head of the Ministry of Economy’s Washington office, emphasized the impact of Brazil’s economic structure, stating: “[...] Brazil Cost almost destroyed our brave industry. The triple macroeconomic disaster – high-interest rates, appreciated exchange rate, rising taxes – disproportionately affected our manufacturing sector” (Abicalçados, 2022e, pp. 25). These macroeconomic factors reflected broader structural issues, including high labor costs, a complex tax system, poor infrastructure, and the need for a more balanced global integration agenda. This illustrates how the political-economic environment continues to play a decisive role in shaping the dynamics of the fashion and footwear industry in Brazil.

Logistics was another recurring theme, notably in the July 2022 report, which identified it as a major challenge (Abicalçados, 2022g). According to Silva (2016), logistics ensures the efficient movement of people, materials, and products. In Brazil, however, logistics consumes around 13% of GDP, due to infrastructure deficits, high freight costs, and insecurity. Nunes et al. (2023) reinforce that a well-managed supply chain boosts profitability, customer trust, and delivery speed. The sector’s reliance on road and sea transport—worsened during the COVID-19 pandemic—exposed its vulnerability. To mitigate this, Abicalçados advocates for diversified transport, including air and water (Abicalçados, 2022g).

Technological innovation has emerged as a key strategy to overcome these logistical barriers. Via Marte, for example, has adopted automated logistics systems using barcode tracking for improved traceability and efficiency (Abicalçados, 2022g). Velicko (2022) highlights the advantages of automation, such as better resource allocation, faster market responsiveness, reduced labor dependence, and lower costs. Additionally, system integration among suppliers, manufacturers, and retailers—endorsed by Via Marte’s IT manager, Ivair Kautzmann—can create a more cohesive and efficient supply chain (Abicalçados, 2022g). These initiatives demonstrate that technology is a crucial factor in transforming the logistics landscape of the Brazilian footwear industry.

Finally, several international challenges continue to affect competitiveness. The political and economic instability of Argentina—Brazil’s second-largest importer—has hindered exports, with central bank restrictions aimed at preserving foreign reserves (Abicalçados, 2022g). Currency fluctuations have also weakened the global standing of Brazilian footwear, especially when compared to cheaper Asian alternatives (Guidolin, Costa & Rocha, 2010; Almeida, 2013). Additionally, the recent tax exemption for digital platform purchases under US$50 has sparked concern. While imported shoes enter Brazil tax-free, domestic producers remain subject to heavy taxation, creating unfair competition (Abicalçados, 2023h). Abicalçados responded by appealing to the federal court, citing job losses and human rights concerns in exporting countries (Abicalçados, 2023k). Compounding this issue is the end of payroll tax relief—originally implemented to protect employment—which was vetoed by the government in 2023, prompting further industry resistance (Abicalçados, 2022a; 2023d; 2023f; 2023g; 2023k).

4.3 Market trends in the economic sector of the Brazilian footwear industry

Among the 164 items analyzed in the Abicalçados reports, 53 (32.32%) addressed trends within the Brazilian footwear industry (Abicalçados, 2022a). A key trend observed is the resumption of international fairs, such as Micam Milano and Expo Riva Schuh, which boosted visibility and opened new markets for Brazilian brands (Abicalçados, 2022d; 2022h; 2023b; 2023i; 2023j). Another essential aspect is digitalization, especially the development of the Brazilian Footwear (BF) portal. With over 200 brands, the platform acts as a digital showcase connecting manufacturers with global buyers (Abicalçados, 2022a; 2022c). Pereira and Cardoso (2023) argue that digitalization accelerates and facilitates the internationalization of small and medium-sized enterprises by reducing barriers and enhancing market access, a dynamic reflected in the Brazilian footwear sector.

The COVID-19 pandemic further accelerated digital initiatives, such as virtual commercial rounds, which generated approximately US$4.3 million for brands (Abicalçados, 2022a). Even after the return of in-person events, these virtual mechanisms have persisted due to their logistical and cost advantages, which were vital for financial reorganization post-pandemic: “[...] there are logistical and cost advantages for companies, vital factors for financial reorganization after the serious crisis caused by the new coronavirus pandemic” (Abicalçados, 2022a, pp. 35). Trends also point to strategic market diversification through international missions, especially in Colombia, resulting in a revenue prospect of around US$6.6 million and broadening Brazilian presence abroad (Abicalçados, 2022j; 2023a; 2023b; 2023e; 2023f). Additional market opportunities were also explored in regions like Australia, Russia, and Europe, highlighting geographic expansion efforts. In particular, Priscila Linck noted Australia’s preference for leather products, presenting new export opportunities: “We basically export rubber shoes there... But the fact is that there is a predilection among local buyers for leather products, with attributes of comfort and design” (Abicalçados, 2023f, pp. 17).

The reports also underline the potential of niche markets, such as safety footwear, targeting hospitals, slaughterhouses, agribusinesses, and postal services (Abicalçados, 2022e). These products remained stable even during crisis periods like the pandemic, demonstrating how understanding specific market needs can ensure product permanence (Chiavenato, 2004). Among broader branding and marketing trends, franchising, private label production, and omnichannel planning have stood out. In the January 2022 report, franchising was linked to R$24 billion in Fashion profits in 2021, with brands like Bibi, Usaflex, Jorge Bischoff, Piccadilly, and Democrat investing in unique expansion strategies tailored to digital integration, franchise support, and multichannel efficiency (Abicalçados, 2022a).

Exporting under third-party brands, or private label, is another trend addressed in May 2022 (Abicalçados, 2022c). This model allows Brazilian manufacturers to meet specific demands of international brands, boosting production and exports without necessarily building a global brand identity. This approach resonates with historical precedents from Fensterseifer (1995) and Costa (2004), who noted that, after 1960, major producers such as the US and European countries outsourced production to regions like Vale dos Sinos, Brazil, aiming for cost efficiency and quality. Today, Brazilian companies continue this legacy, adjusting their production to foreign customer specifications, either by creating exclusive collections or manufacturing pre-designed models (Abicalçados, 2022c).

Finally, omnichannel strategies have become increasingly relevant in navigating post-pandemic consumer behavior. Highlighted in the September 2022 report, these strategies integrate physical stores, e-commerce, telesales, mobile apps, and marketplaces into a unified retail experience (Abicalçados, 2022i). Gonsales, an omnichannel expert, emphasizes that modern consumers now demand personalized and seamless interactions across all platforms. Therefore, companies are urged to train staff, standardize pricing and inventory, and enhance communication through social media. In terms of domestic revenue, while brands show ongoing recovery and investment, growth remains moderate, with projected increases of 1.6% to 2.1% for 2023 and 2024 (Abicalçados, 2022d; 2022g; 2022j; 2023a; 2023b; 2023c; 2023f; 2023h; 2023k). This indicates cautious optimism in the internal market amid global expansion efforts.

5. DISCUSSIONS

5.1 Theoretical implications

Considering what was presented, the research demonstrates the relevance of issues such as digitalization and internationalization for the growth of Brazilian footwear companies, corroborating previous studies on reducing barriers to entry into international markets through digital platforms (Jean; Kim; Cavusgil, 2020; Stallkamp; Schotter, 2021; Caputo et al., 2022). Digitization, exemplified by the Brazilian Footwear platform, shows that technology can facilitate access to new markets and accelerate the internationalization process, aligning with the theories of globalization and e-commerce (Cha; Kotabe; Wu, 2022; Johanson & Vahlne, 2017; Loonam; O’Regan, 2022; Yan et al., 2023; Ballerini et al., 2024). Afterward, studies by Pereira and Cardoso (2023) are reinforced, showing that digitalization reduces barriers and enhances the global visibility of brands.

The search for new markets and customer diversification highlights the importance of the geographic expansion strategy and the need for constant innovation. This aligns with global value network studies, which emphasizes the importance of integrating into global networks to ensure competitive advantage (Alves et al., 2022), especially after the COVID-19 pandemic (McWilliam; Nielsen; Kottaridi 2023).

The findings of this study show that the Brazilian footwear industry operates on a low-cost model, becoming an outsourcing platform for brands from the United States and Europe. Therefore, Internalization Theory explains international expansion as a response to cost advantages gained from operating in foreign markets. Many scholars consider it the clearest application of Transaction Cost Theory (Williamson, 1975) to international business. Buckley and Casson (1976), the theory’s primary proponents, argued that firms expand internationally based on their cost structures. They suggested that companies typically start with exports and progress to local production if they prove more cost-effective than alternative modes of activity.

In a complementary way, the eclectic paradigm (known as the OLI Model) helps to explain the internationalization based on low costs because is based on three points: a) ownership or the ability to acquire certain tangible or intangible assets that are not available to competitors (O - ownership); b) the location of assets (L - location), which can be situated in different countries or markets, and; c) internalization (I - internalization), which represents the ability to internalize and transfer assets across borders (Dunning, 1988).

At the same time, the Brazilian footwear industry also operates according to the behavioral perspective of internationalization, as it has Latin America among its main markets. This is due to the low psychic distance caused by proximity in terms of language and culture (Johanson & Vahlne, 1977). In addition, the formation of networks based on the business relationships (Johanson & Vahlne, 1990) of institutions such as Abicalçados enables the creation of new internationalization opportunities.

Moreover, this study presents evidence that product and market diversification minimize risks and increase companies’ resilience in crisis scenarios (Aivazian; Rahaman; Zhou, 2019). However, as seen in the study of Garrido-Prada, Delgado-Rodriguez, and Romero-Jordán (2019), product diversification alone does not always positively impact performance during economic downturns unless combined with high levels of geographic diversification, which also justifies the constant search of the Brazilian footwear industry for new countries of operation.

Discussions related to franchising, private label and omnichannel trends highlight the need for continuous adaptation to market changes and innovation in business models. The concepts of open innovation (Abulrub; Lee, 2012) and dynamic business models (Corallo et al., 2019) is pointed out here, showing that flexibility and ability to integrate multiple sales channels are crucial for the sustainability of companies (Oh; Teo; Sambamurthy, 2012; Cao; Li, 2015). The integration of omnichannel strategies provides a cohesive and personalized shopping experience, reflecting the importance of the customer experience in competitiveness (Hajdas; Radomska; Silva, 2022).

5.2 Managerial implications

For industry managers, this research shows that participation in international fairs and the use of digital platforms, such as Brazilian Footwear, are essential to increase global visibility and facilitate the prospecting of new markets. Furthermore, companies must invest in digitalization to maintain and expand their international presence (Jean; Kim; Cavusgil, 2020; Stallkamp; Schotter, 2021; Caputo et al., 2022).

Product and market diversification should also be a strategic priority (Aivazian; Rahaman; Zhou, 2019; Garrido-Prada; Delgado-Rodriguez; Romero-Jordán, 2019). Analyzing potential markets such as Australia, Russia and Europe and identifying specific niches where Brazilian products can stand out, such as leather shoes with comfort and design attributes, can open new revenue opportunities and reduce risks.

Furthermore, we highlight that investments in technology and automation in logistics are imperative to increase efficiency and reduce costs, which is essential to compete globally (Silva, 2016; Nunes et al., 2023). Logistics efficiency is crucial for effective global delivery, moreover, diversifying transport modes can mitigate risks associated with dependence on highways and maritime transport (Silva, 2016; Nunes et al., 2023). Producers in the Brazilian footwear industry must be aware of exchange rate fluctuations and the cost of raw materials, adapting their pricing and negotiation strategies as necessary (Costa, 2010; Chatterjee; Dix-Carneiro; Vichyanond, 2012).

Strengthening relationships with international customers through personalized service and product innovation, combined with production flexibility and the quality of Brazilian products, are competitive differentiators that must be continually improved to maintain competitiveness in the global market (Costa, 2010).

FINAL CONSIDERATIONS

Industrial production of consumer goods fluctuated during the pandemic, and the footwear sector was no exception. Despite these ups and downs, the sector’s maintenance strategies effectively restored profitability post-pandemic. This paper analyzed the trends, results, and challenges faced by the Brazilian footwear industry economic dimension between 2022 and 2023. We conducted documentary research on 21 Abinforma reports by Abicalçados, totaling 637 pages and 238,819 words, using qualitative thematic-categorical content analysis to focus on the economic dimension of the industry.

The findings of this study underscore the pivotal role of internationalization, digitalization, and market diversification in strengthening the Brazilian footwear industry’s global competitiveness. This growth trajectory is further reinforced by consistent export performance, with revenues surpassing US$1 billion annually and key states such as Rio Grande do Sul, Ceará, and Paraíba leading the sector’s international expansion. The industry’s ability to sustain high export levels highlights its strategic role in Brazil’s economic recovery, even as domestic market growth remains moderate.

Additionally, job creation reached historic highs in 2022, reflecting a strong recovery post-pandemic, but 2023 saw fluctuations due to increased competition from international digital marketplaces. Investments in research and development, growing by 33.4%, have enhanced product quality, sustainability, and technological innovation, strengthening the global reputation of Brazilian brands. The emphasis on production flexibility, high-quality raw materials, and close relationships with international buyers has positioned the industry as a key player in the global footwear market, reinforcing its long-term competitiveness despite structural challenges.

However, despite these advancements, significant structural challenges continue to impact the industry’s growth and competitiveness. Exchange rate volatility, high production costs, and logistical inefficiencies remain critical barriers, exacerbated by external factors such as geopolitical tensions and shifts in global trade policies. The lack of infrastructure and high freight costs have further strained supply chains, underscoring the need for investment in logistics optimization and alternative transportation methods. Additionally, recent tax exemptions on imported footwear sold through digital platforms have placed domestic manufacturers at a disadvantage, raising concerns about unfair competition and job losses. The industry’s response has included legal action and advocacy for stronger trade protections, yet uncertainties persist. Overcoming these challenges will require policy interventions, technological advancements, and stronger collaboration between industry stakeholders to ensure long-term sustainability and reinforce Brazil’s position as a key player in the global footwear market.

As for the trends, the resurgence of international trade fairs and the adoption of digital platforms, such as Brazilian Footwear (BF), have facilitated market expansion and enhanced brand visibility. Additionally, strategic initiatives, including trade missions to Colombia and emerging opportunities in Australia, Russia, and Europe, have driven export growth. The industry’s adaptability is also evident in its focus on niche markets, such as safety footwear, and the increasing relevance of business models like franchising, private label exports, and omnichannel retailing. While domestic market recovery has been gradual, these strategies position the sector for long-term resilience and sustained international presence, highlighting the importance of continued investment in logistics, innovation, and trade partnerships.

Therefore, to ensure continued growth, the industry must balance short-term adaptations with structural improvements. Enhancing logistics infrastructure, fostering innovation in product development, and strengthening international trade partnerships will be crucial. The findings of this study underscore the importance of proactive governmental policies and sector-wide collaboration in overcoming challenges.

For future research, we suggest exploring: (i) the impact of business fairs on brand commercialization and internationalization in the Brazilian footwear sector; (ii) the effectiveness of sustainability strategies for competitive advantage; (iii) the role of associations like Abicalçados in sector growth and post-pandemic challenges; and (iv) the relationship between sustainability certification and consumer perception of Brazilian footwear brands.

End notes

¹ The reference list of the Abicalçados reports can be found, along with the replication package, in the research’s repository on GitHub: https://github.com/ItaloDantas19/IndustriaCalcadista (Acesso em: 26 mar. 2025).

REFERENCES

ABULRUB, A.H.G.; LEE, J. Open innovation management: challenges and prospects. Procedia - Social and Behavioral Sciences, v. 41, p. 130-138, 2012.

AIVAZIAN, V.A.; RAHAMAN, M.M.; ZHOU, S. Does corporate diversification provide insurance against economic disruptions? Journal of Business Research, v. 100, p. 218-233, 2019.

ALMEIDA, T.A.A. The insertion of Bahia in the footwear industry relocation movement in Brazil. Cadernos de Ciências Sociais Aplicadas, v. 9, n. 13, 2013.

ALVES, L.G. et al. The rise and fall of countries in the global value chains. Scientific Reports, v. 12, n. 1, p. 9086, 2022.

ASMARE, A.; ZEWDIE, S. Omnichannel retailing strategy: a systematic review. The International Review of Retail, Distribution and Consumer Research, v. 32, n. 1, p. 59-79, 2022.

BALLERINI, J. et al. The e-commerce platform conundrum: How manufacturers’ leanings affect their internationalization. Technological Forecasting and Social Change, v. 202, p. 123199, 2024.

BARDIN, L. Análise de conteúdo. Lisboa: Edições 70, 1977.

BUCKLEY, P.; CASSON, M. C. The future of multinational entreprise. London: Macmillan, 1976.

CAO, L.; Li, L. The impact of cross-channel integration on retailers’ sales growth. Journal of Retailing, v. 91, n. 2, p. 198-216, 2015.

CAPUTO, F. et al. Digital platforms and international performance of Italian SMEs: an exploitation-based overview. International Marketing Review, v. 39, n. 3, p. 568-585, 2022.

CHA, H.; KOTABE, M.; WU, J. Reshaping internationalization strategy and control for global E-commerce and digital transactions. Management International Review, v. 63, n. 1, p. 161-192, 2023.

CHATTERJEE, A.; DIX-CARNEIRO, R.; VICHYANOND, J. Multi-product firms and exchange rate fluctuations. American Economic Journal: Economic Policy, v. 5, n. 2, p. 77-110, 2013.

CHIAVENATO, I. Strategic planning. São Paulo: Elsevier Brasil, 2004.

CORALLO, A. et al. Dynamic business models: a proposed framework to overcome the death valley. Journal of the Knowledge Economy, v. 10, p. 1248-1271, 2019.

COSTA, A.B. The competitive trajectory of the footwear industry in Vale dos Sinos. In: COSTA, A.B.; PASSOS, M.C. (Eds.). A indústria calçadista no Rio Grande do Sul. São Leopoldo: Editora Unisinos, ٢٠٠٤. p. ١٤٩-١٧٨.

COSTA, A.B. Institutions and competitiveness in the footwear cluster of Vale dos Sinos. Análise Econômica, v. 27, n. 52, 2010.

COSTA, A. B.; PASSOS, M.C. The footwear industry in Rio Grande do Sul. São Leopoldo: Editora Unisinos, ٢٠٠٤.

COSTA, A. B. D. The footwear industry in Vale do Sinos (Brazil): competitive adjustment in a labour-intensive sector. Cepal Review, n. 101, p. 157-172, 2010.

DUNNING, J. H. The eclectic paradigm of international production: a restatement and some possible extensions. Journal of International Business Studies, v. 19, n. 1, p. 1-31, 1988.

DUNNING, J. H.; LUNDAN, S. M. Multinational enterprises and the global economy. Cheltenham: Edward Elgar, 2008.

FENSTERSEIFER, J.E. The Footwear Complex in Perspective: Technology and Competitivenes. Porto Alegre: Ortiz, 1995.

GARRIDO-PRADA, P.; DELGADO-RODRIGUEZ, M.J.; ROMERO-JORDÁN, D. Effect of product and geographic diversification on company performance. European Management Journal, v. 37, n. 3, p. 269-286, 2019.

Gil, A. C. Methods and Techniques of Social Research. 6. ed. São Paulo: Editora Atlas, 2008

GUIDOLIN, S. M.; COSTA, A. C. R.; ROCHA, É. R. P. Footwear industry and competitiveness strengthening strategies. BNDES Setorial, v. 31, p. 147-184, 2010.

HAJDAS, M.; RADOMSKA, J.; SILVA, S. C. The omni-channel approach: a utopia for companies? Journal of Retailing and Consumer Services, v. 65, p. 102131, 2022.

HYMER, S. H. The international operations of national firms: a study of direct foreign investment. Cambridge: MIT Press, 1976.

JEAN, R. B.; KIM, D.; CAVUSGIL, E. Antecedents and outcomes of digital platform risk for international new ventures’ internationalization. Journal of World Business, v. 55, n. 1, p. 101021, 2020.

JOHANSON, J.; VAHLNE, J. The internationalization process of the firm: a model of knowledge development and increasing foreign market commitments. Journal of International Business Studies, v. 8, n. 1, p. 23-32, 1977.

JOHANSON, J.; VAHLNE, J. E. The mechanisms of internalization. International Marketing Review, v. 7, n. 4, p. 11-24, 1990.

JOHANSON, J.; VAHLNE, J. E. The internationalization process of the firm—a model of knowledge development and increasing foreign market commitments. In: International business. Routledge, 2017. p. 145-154.

KRIPKA, R. M. L.; SCHELLER, M.; BONOTTO, D. L. Documentary research in qualitative research: concepts and characterization. Revista de Investigaciones, v. 14, n. 2, p. 55-73, 2015.

LOONAM, J.; O’REGAN, N. Global value chains and digital platforms: Implications for strategy. Strategic Change, v. 31, n. 1, p. 161-177, 2022.

McWILLIAM, S.; NIELSEN, B. B.; KOTTARIDI, C. Global value chains and liability of international connectivity. European Journal of International Management, v. 21, n. 1, p. 121-139, 2023.

NUNES, P. S. A. et al. Mapping and analysis of the supply chain: a case study in the footwear industry. Brazilian Journal of Production Engineering, v. 9, n. 2, p. 99-112, 2023.

OH, L. B.; TEO, H. H.; SAMBAMURTHY, V. The effects of retail channel integration through the use of information technologies on firm performance. Journal of Operations Management, v. 30, n. 5, p. 368-381, 2012.

PENROSE, E. T. The theory of the growth of the firm. Oxford: Oxford University Press, 1959.

PEREIRA, R.; CARDOSO, A. R. Does digitalization and the adoption of industry 4.0 components matter for the internationalization of Portuguese small and medium enterprises? Future Studies Research Journal: Trends and Strategies, v. 15, n. 1, e0694, 2023.

REICHERT, C. L. The technological evolution of the footwear industry in Southern Brazil. In: COSTA, A. B.; PASSOS, M. C. (Eds.). A indústria calçadista no Rio Grande do Sul. São Leopoldo: Editora Unisinos, 2004. p. 179-204.

SAMPAIO, R. C.; LYCARIÃO, D. Categorical content analysis: application manual. Brasília: Enap, 2021.

SCHEMES, C. Pedro Adams Filho: entrepreneurship, footwear industry and the emancipation of Novo Hamburgo: 1901-1935. Tese (Doutorado em História) – Pontifícia Universidade Católica do Rio Grande do Sul. Porto Alegre, 2006.

SCHWEIZER, R.; VAHLNE, J. E.; JOHANSON, J. Internationalization as an entrepreneurial process. Journal of International Entrepreneurship, v. 8, n. 4, p. 343-370, 2010.

SCHNEIDER, J. O. Cooperativism and sustainable development. Otra Economía, v. 9, n. 16, p. 94-104, 2015.

SILVA, L. A. D. et al. Logistics: international and national evolution. Revista de Administração e Negócios da Amazônia, v. 8, n. 3, p. 386-406, 2016.

STALLKAMP, M.; SCHOTTER, A. P. Platforms without borders? The international strategies of digital platform firms. Global Strategy Journal, v. 11, n. 1, p. 58-80, 2021.

VELICKO, A. J. Design of an automated internal logistics system for an industry. Dissertação (Mestrado) – Universidade de Passo Fundo. Passo Fundo, 2022.

VERNON, R. International investment and international trade in the product cycle. The Quarterly Journal of Economics, p. 190–207, 1966.

WILLIAMSON, O. E. Market and hierarchies: analysis and antitrust implications. New York: The Free Press, 1975.

YAN, Z. et al. Institutional distance, internationalization speed and cross-border e-commerce platform utilization. Management Decision, v. 61, n. 1, p. 176-200, 2023.